How to Build an Effective Personal Finance Application

Share This Article

Table of Contents

Subscribe to Our Blog

We're committed to your privacy. SayOne uses the information you provide to us to contact you about our relevant content, products, and services. check out our privacy policy.

For anyone that wants to remain financially secure, it is equally important to track expenses on time just as much as keeping count of the money that is flowing in. It is important to have effective control of money flows. Earlier if people maintained their accounts manually, and money management is an overwhelming job as everyone will agree. Today’s money management systems come as simple mobile apps that have made life easier for many individuals.

With the pandemic looming large, it may be the best time to create a personal finance app. Funds are tight and every person is in dire need of saving money for the future. Everybody wants to save and many want to do it from the comfort of their homes. According to a survey in 2019 by Statista, approximately 35% of the respondents in the 25-34 age brackets used some kind of personal finance apps to help them budget their expenses.

Now, these apps are present on individuals’ mobile phones and the market share for personal finance apps is promising as of now. Why not build one and get a share of the pie?

What Do Finance Apps Have to Offer

Let us see what functionalities that personal finance apps currently in the market deliver.

The basic functions that these apps perform are listed as follows:

- Strictly control the user’s finances

- Keep track of the income and expenditure

- Plan the budget

- Be constantly aware of the user’s savings

- Pay the bills for utilities/services

- Make money

The ‘making money’ part is all about helping the user with making small investments and savings.

Read our blog Outsourcing Python Programming Projects to India

Finance apps are categorized as ‘manual’ when the record entries have to be keyed in personally to indicate the income and expense transactions and as ‘linked’ when the app draws in the transactions automatically. The second type involves more complexities but has more benefits.

Manual Finance Apps

This type of personal finance app allows for manual entry of all the expenses by the user. These apps are designed to keep track of the expenses, and also help to plan the large expenses.

Pros:

The pros of using such apps are that they are highly secure as the user does not use bank cards. Further, they are simpler and cheaper.

Cons:

The transactions are error-prone as there is human intervention and the time costs are significant.

It is a good idea to focus on the UI/UX design of manual apps to reduce the tediousness of making the entries manually. For those that are intent on creating personal finance apps but do not have the resources to make the automatic entry types, do not think that creating and marketing a simple personal finance app will not get you closer to your financial goal. Just remember that your approach has to be unique and appealing to the users.

Linked Finance Apps

Linked finance apps are more complex because the cards and bank accounts of the user are linked to the program. The data for each transaction is received by the program and updated automatically.

Read our blog "Python for Business Analytics Applications"

Pros:

Such finance apps make the user’s life easy by creating the transaction entries on their own. The efficiency is high as the program does not rely on the user’s memory. Erroneous transactions are thus avoided.

Cons:

Security may be at stake because of entrusting card and bank details to the machine. Linked apps are more expensive and complex to make.

Personal Finance Apps in the Market

There are many players in the market of personal finance apps. It is important to know what these apps do and what they don’t if you want to enter this market soon.

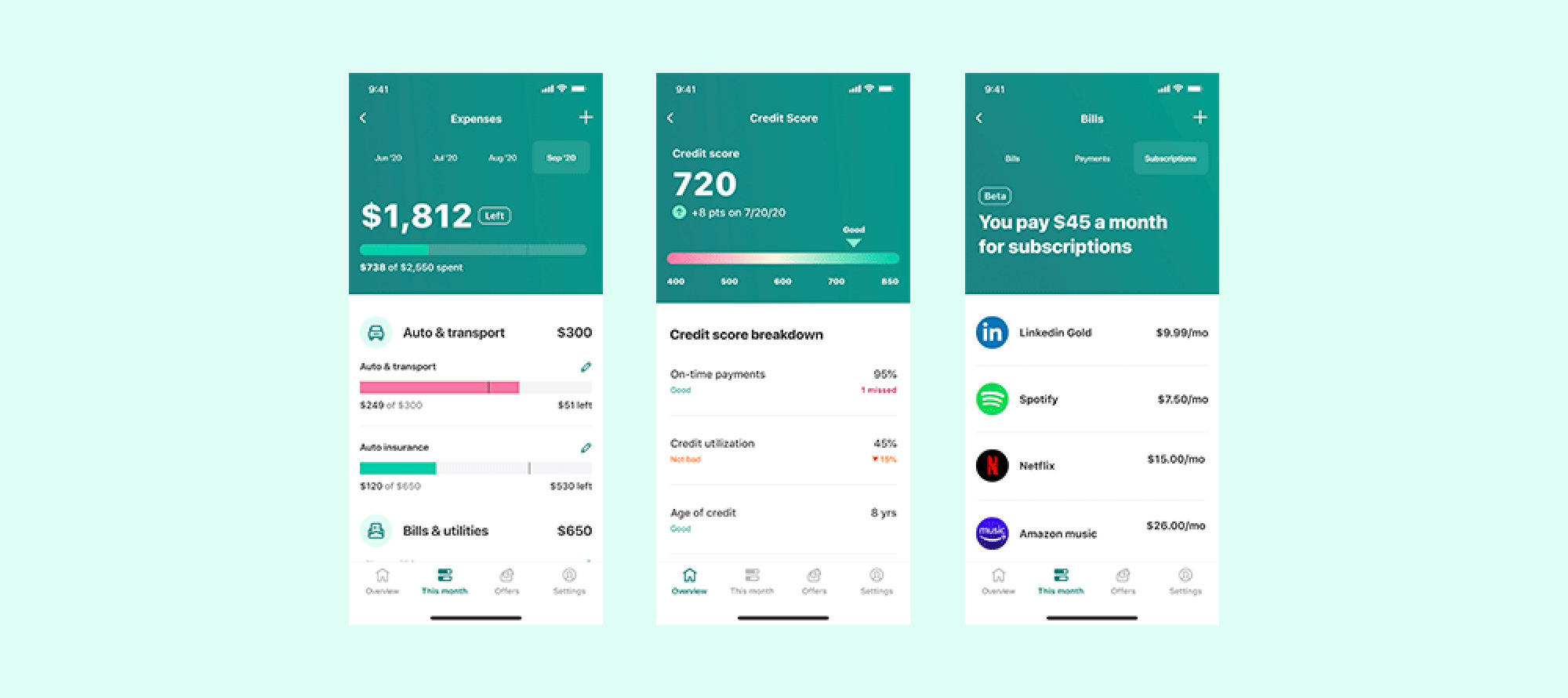

Mint

Download Now: Development process for the layperson and what does it take to build an application

This manual entry personal finance app has more than 14 million users and is present in the market since 2008. This app has many unique features and this probably has been a reason why it has been a favorite all along.

Pricing: Free

Some of its Features include:

- Managing and tracking personal finances through a single UI

- Easy and comfortable account head categorization

- Easy and automatic bank and credit cards classification

- Selected information available when offline

- Expense planning: daily/monthly/any period

- Different types of notifications/alerts

- Graphic displays

- Geo-tags to track purchases

- They support different OS platforms (iOS and Android)

- This app uses in-app advertising for monetization.

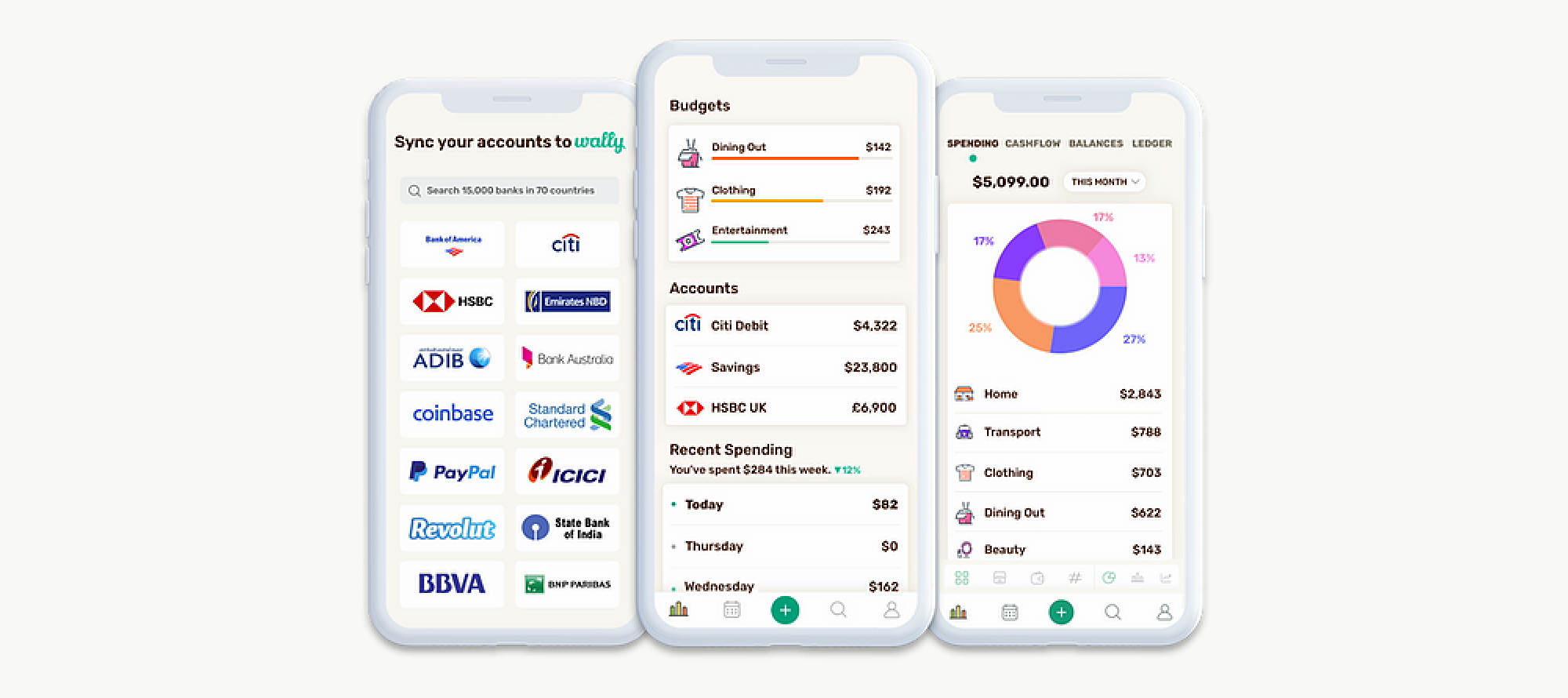

Wally

This is yet another personal finance app that requires manual data entry for financial transactions. However, it is a very popular app that has users across 52 different countries.

Read our blog "Server scaling with AWS Lambda for Python"

Features:

- It is very user-friendly

- It uses geolocation features to track the place of purchase

- The app tracks user preferences and spending habits

- Smart notifications in terms of events related to financial activity

- Competent transaction analysis

- This app offers advanced features such as currency converters, advanced filters, and repeated notification via paid offers.

What do People Expect from Finance Apps

Now that we some idea of what the apps of today offer to the users, let us move to analyze the next part. This is where the rubber meets the road. To build a good personal finance app, you need to think as to what people need out of a personal finance app. What do people expect to get out of it?

- User authorization and creation of accounts

- Versatile categorization and manage regular payments

- View all the bank balances easily and their overall financial status

- Links to all the cards and bank accounts in case you decide to make a linked personal finance app

- Integration with banks and receipt scanning

- Currency conversion

- Set daily/monthly budgets

- Standard reports on demand by categories and display expenses dynamics

- Regular reminders of payment system and post notifications

- Make a note of the users’ purchase habits and expenses

- Backup on Google Drive or Dropbox

- Expense tracking and real-time updates

- Goal-setting with tracking the progress facilities

Features of a Powerful Personal Finance Application

To attract the maximum number of users in the market when you launch a personal finance app, some of these features are a must.

Download Now: Development process for the layperson and what does it take to build an application

1: Pay Attention to Security Aspects

- Every user must feel secure when using a personal finance app. They should be convinced that the money data is held securely for them to continue using the app.

- Secure apps generally have two-factor authentication. The user of the app is identified via two independent channels for every single use of the app. The first level of protection is offered by using the login id and the password for the user and the second level of protection is via an OTP.

- Any transmitted data is sent via the SSL protocol link remains encrypted. This assures that the data between the browser and the server remain private and safe.

- It is also important that you provide only short-term sessions so that the programs do not run unprotected for a long period.

- Display user information to a level only that is essential. Ensure that user precious information is not displayed in big bold letters.

- It is not a good idea to trust open-source libraries completely. Be discrete about the information that you share with these libraries. In this context, you should also be wary about closed-source libraries. Many of them are not as reliable as they seem to be.

- Any leak of the users’ personal data amounts to infringement of human rights and can cause problems.

- If you are building a personal finance app, pay adequate attention to GDPR (General Data Protection Regulation) and PCI DSS (Payment Card Industry Data Security Standard).

2: Think as your Users do

If you know where you want your app to go, analyze the user adequately before you make the app. Speaking their language, using symbols and figurines they like, can help you get there. Focusing on the age group that you want to serve can help you to infuse the right UI/UX and money ideas to captivate their attention.

3: Simple Programs Create More Appeal

When it is about money, people prefer simple ways to manage this resource. Personal finance apps are required to be flexible and simple to use. Follow the 3-click rule, that is, the user should be able to reach the screen that they are looking for with just 3 clicks.

Do not go for a single screen with all the information as it is likely to be confusing. However, do not use too many screens for the user to click through to accomplish any action. Go for an optimum number that will suit the users.

Read our blog "Python Applications List - 7 Types that can be Developed"

Are you looking to build a simple intuitive and effective personal finance app? Consult with us today!

4: UX Design

Do not use cluttered designs and screens for the best effects. Engage experienced UI/UX experts to design the screens for the app. It is vital to follow the latest trends in this aspect.

5: Customer Service

Providing 24/7 customer service is part and parcel of creating a personal finance app. If you plan to launch in many countries, ensure you provide multilingual customer support.

6: Cross-platform support

In case you are targeting a wide spectrum of users, your personal finance app should work o different platforms, iOS, Android and other OS. Due attention has to be paid to this aspect during the development process.

7: Personalization

Users may want joint finance options for couples or an option to teach children and teens the basics of financial management. These can be included to help the app reach more customers.

8: Analytics and Reporting

Make arrangements to display several reports in specific formats to reflect a list of the expenses and to give the user a clear picture of the money they have.

Read our blog "Python for Business Analytics Applications"

You can pick other features from the following list:

- Provide investment insights, guidance

- Money management tips

- Forecast of future expenses, graphic depiction, analytics

- Product/service comparisons

Personal Finance App Design Considerations

Various discussions prove that customers want a simple and intuitive design when it comes to personal finance apps. A minimalist approach is most appealing. Time and again it has been proved that simple interfaces elicit more trusted responses from the users. For this, the UX designer has to find out more about the app’s intended users and their habits. People use their finance apps while on the go and this is the very reason why they should be simple, secure, and fast.

Designers have to be familiarized with how their design differs from the apps of others. Also minimizing complexities during the verification processes make it more appealing.

Micro-animations that respond to users’ actions find a place in most personal finance app designs. These animations are generally used for sliders, buttons and icons. They display the state that the user is in and what they can expect next.

Personal Finance App – Technology Stack Used

The two common approaches followed while building apps are native development and cross-platform development. Native development is done using languages such as Swift (for iOS) and Java/Kotlin(for Android). Some of the common cross-platform technologies used are Flutter and React Native.

The Java Spring Boot framework and Python technology can also be used to create extensive finance applications.

Read our blog Hire Java Spring Boot Developers from India

Financial data APIs are required to be used to make separate programs interact with one another. This helps the apps to connect with banking functions to access the required data.

Personal Finance App – Development Cost and Time

The development team for building a personal finance app can be constituted with the following members: a project manager, designer, two mobile developers (or more) and two backend developers depending on the required development speed required, and a QA engineer.

Finance App Development Costs – an Overview

- Hiring freelancer developers would cost you about USD 10/hour.

- You can manage with an in-house development team. The costs would be between USD 80/hour to USD 150/hour. This allows more control and you can have data confidentiality.

- Hiring an outsourced development team is the third option you are left with. You would be able to hire talented professionals from anywhere in the world. You can contact professional software technology companies that are ready to provide entire teams for a period to build your app.

- The time taken to build a personal finance app could take up to 2500 hours of development time. The average finance app development cost could be as much as USD 100,000.

App Monetization

There are different ways of monetizing your personal finance app. You can make your app a monthly/yearly subscription-based app or use other methods like in-app advertising or in-app purchases.

Are you looking to hire a development team? Give us a call today!

However, the best way to start would be to make it free in the beginning so that more users can try your app. However, you can enable a set of basic features that a user would need. They can then use it for a period of time to see if they like the app. To get the advanced features, you can make it a pay-for-extra-feature (receipt scanning, automated expense tracking, etc.) model.

Personal Finance App – Latest Trends

With millions of apps making their way into the play stores every day, it is important for every app maker to incorporate features so that users pick up their apps and keep on using the app.

Some of the Trending Features are:

- Voice commands

- Use of AI to track spending habits

- Incorporation of gamification features

Final Tip

Do your homework with due diligence, find out what your competitors have and what they do not have on their personal finance app. If you are tight on the budget, start with an MVP and then build it big if this is your first app. Try to imagine what your app would accomplish better than the others’ apps and go for it. It will likely be a success.

Why Choose SayOne Technologies

Hiring an outsourced development team from SayOne Technologies has more advantage than one. You get to combine the all advantages of an in-house team while being able to source the best talent from in the field of app development. We present you with a wider choice of professionals from which you can take your pick.

Further, the risk that you take is shared in case you opt for hiring an outsourced development team from us. There are no hassles of recruitment, recruitment charges are zero, we do it for you.

It is also not a good idea to buy an off-the-shelf finance app solution as they may not be scalable. By hiring an outsourced development team from our organization, you get to keep an expert, experienced and dedicated team throughout the development period. You can build a flexible and customized finance application the way you want it.

Are you looking to hire a development team? Give us a call today!

Share This Article

Subscribe to Our Blog

We're committed to your privacy. SayOne uses the information you provide to us to contact you about our relevant content, products, and services. check out our privacy policy.